A strategic, data-driven briefing on senior home care market dynamics, operational challenges, and why veteran-led operators consistently outperform.

Table of Contents

1.0 The Unavoidable Opportunity: A Generational Demand Shift

The ongoing demographic shift in the United States is not a fleeting trend; it is a fundamental, long-term economic reality. The aging of the Baby Boomer generation, often called the “Silver Tsunami,” has made landfall, creating a predictable, multi-decade demand cycle for senior care services. For the strategic entrepreneur, understanding the sheer scale of this shift is the first step in recognizing the immense and durable value proposition of the senior care industry. This is not a market bubble; it is a foundational change in the economic landscape.The magnitude of this opportunity is defined by a powerful convergence of demographic, financial, and preferential forces:

- The Demographic Landfall: The market is expanding at a staggering rate. Approximately 10,000 Americans turn 65 every single day , a pace that will continue for years. By 2030, a historic 1 in 5 Americans will be of retirement age . This is not a short-term surge but the beginning of a sustained 25-year growth cycle for the senior care sector.

- Unprecedented Generational Wealth: This is not just a large generation; it is the wealthiest in history. Baby Boomers and seniors control roughly 75% of all personal wealth in the U.S. , representing what can be viewed as a $54 trillion retirement fund . This vast reservoir of capital allows them to reject subpar options and prioritize premium, comfortable care for themselves and their loved ones.

- The Overwhelming Client Preference: Consumer demand is overwhelmingly pointed in one direction: the home. A critical 91% of seniors report a preference to “age in place” at home rather than move to an institutional facility. This single data point is the primary driver fueling the demand for home care services and explains why the facility-based model is being left behind.This confluence of an aging population, immense financial resources, and a clear preference for in-home services creates a market dynamic of unparalleled strength and predictability.

2.0 Market Deep Dive: Why Home Care is the Premier Battlefield

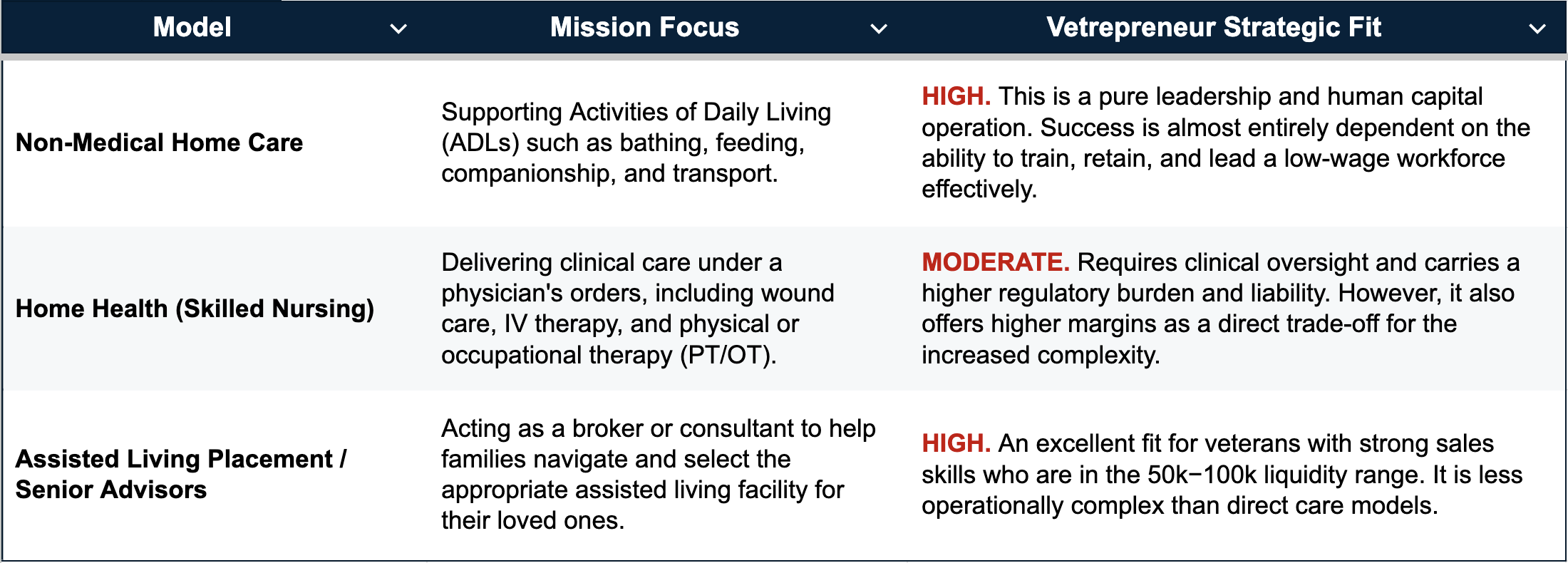

The senior care market is undergoing a strategic realignment, shifting away from capital-intensive, facility-based models toward more flexible and consumer-preferred home-based care. This “flight to quality” is driven by the client’s desire for independence and comfort, making the home care franchise model an exceptionally stable and valuable investment. For the veteran entrepreneur, understanding the distinct operational theaters within this sector is crucial to selecting the right mission profile.

3.0 The Economic Realities: Resilience and Risk

The senior care industry is fortified by a unique economic moat that sets it apart from nearly all other consumer-facing sectors. Its needs-based nature makes it highly resilient to economic downturns and market volatility. However, this resilience is not absolute and is paired with a specific financial risk that a savvy operator must be prepared to manage from day one.The industry’s financial profile is a dual-edged sword. On one side, it is profoundly recession-resistant . When economic uncertainty forces households to tighten their budgets, discretionary spending on luxuries like restaurants and retail is the first to go. In stark contrast, families view safety-critical care for an elderly parent as a non-negotiable priority. Data shows that this unwavering commitment maintains steady demand for senior care services regardless of broader market conditions. On the other side, the primary economic threat is that the industry is acutely Wage-Inflation Sensitive . Because the business model is labor-intensive, profit margins are directly squeezed when the cost of labor—caregiver wages—rises faster than the hourly rates that can be billed to clients.This sensitivity to labor costs leads directly to the core operational challenge that defines success or failure in this sector: the relentless “Staffing War.”

4.0 The Core Challenge: Winning the "Staffing War"

The single greatest operational challenge and the primary failure mode in the senior care sector is the recruitment and retention of qualified caregivers. This is the “Staffing War,” and it is constant. Winning this war is not a human resources problem; it is a leadership and command challenge that separates top-tier operators from the rest of the field.Two distinct operational philosophies dominate the approach to this challenge, with vastly different outcomes:

The “Civilian Operator Approach” often treats caregivers as a replaceable commodity. This transactional mindset leads to poor onboarding, unclear expectations, and a lack of support, resulting in catastrophic churn. With an industry average caregiver turnover rate of 60-80% , this approach guarantees a constant state of crisis, with missed shifts, angry clients, and ultimately, a failed business.

In contrast, the “Veteran Operator Approach” applies “NCO-style leadership” guided by a “Mission First, People Always” ethos. This method treats the caregiver team as the most valuable asset. Veteran owners instinctively implement superior tactics: better onboarding processes, clear Standard Operating Procedures (SOPs), genuine respect for their personnel, and decisive leadership in a crisis. The outcome is clear: veteran-led agencies typically achieve 15-20% higher retention rates than their civilian peers because they know how to lead teams in stressful, mission-critical environments.

This distinction in leadership reveals the most critical mindset shift required for success. A noble desire to “help people” is insufficient. An owner must embrace the reality that this is a management role, not a bedside role. The mission is to manage the people who help people . This is the core function of the operational leader.

It is crucial to dispel the dangerous myth of passive ownership in this industry. The reality is far more demanding:

Myth: "I will hire a manager and run this semi-absentee."

Reality: In the first 12-24 months, you are the Recruit Commander. A veteran’s unique ability to win the Staffing War is the most critical advantage, but it is part of a broader alignment between their entire skill set and the fundamental demands of this business.

5.0 The Veteran Advantage: A Mission-Profile Match

The central argument for veteran ownership in this sector is simple: Senior care is not a “caregiving” business; it is a high-stakes logistics and human capital business. It is a high-friction, high-regulation, mission-critical environment where success is determined by operational excellence, not clinical expertise. Military training provides the ideal framework for mastering these challenges and outperforming the competition.Veterans consistently emerge as the top-performing owners in this sector for three core reasons:

- Systems-Minded: Veterans are trained from day one to follow, internalize, and perfect a playbook. In the world of franchising, where a proven system is the core asset, this discipline is the secret to rapid and sustainable scaling.

- Accountability: In an industry where people’s lives and well-being are on the line, trust is the ultimate currency. Veterans bring a level of discipline, responsibility, and seriousness of purpose that families instinctively recognize and trust when making one of the most important decisions of their lives.

- Logistical Precision: The daily reality of a home care agency involves managing complex caregiver schedules, client needs, and geographical territories. This requires the same high-level coordination and logistical planning that military leaders have already mastered in far more complex environments.While the veteran skillset is a perfect match for the operational demands, a successful venture also requires a specific financial profile and a clear understanding of the business’s long-term trajectory.

6.0 The Financial Blueprint: Capital, Commitment, and The J-Curve

Aspiring entrepreneurs must understand that the senior care industry is not a cash-flow-immediate business. It is an Equity Play -a venture focused on building a highly valuable long-term asset. The financial trajectory follows a distinct “J-Curve,” where initial investment and effort precede profitability. Understanding the capital requirements and this financial timeline is critical for survival and ultimate success.

The “J-Curve” Reality

The path to building a valuable senior care agency follows a predictable, multi-year progression:

- Year 1: This period is defined by high stress and low margins. The primary focus is on winning the Staffing War by building a robust and reliable roster of caregivers.

- Year 3: The business begins to mature. Recurring revenue from a stable client base starts to stabilize, and operational systems become more efficient.

- Year 5: The agency has become a high-value asset. With a proven track record of revenue and profitability, the business is well-positioned for a lucrative exit, as EBITDA multiples for established senior care agencies are historically strong.Success demands a precise combination of operational leadership, sufficient capital, and a mission focus aligned with the long-term nature of this asset class.

7.0 Final Verdict: A Call to Operational Leadership

The senior care sector represents a Tier-1 opportunity for veteran entrepreneurs, but only for a specific archetype who understands and embraces the operational realities of the business. This is not an industry for the passive investor or the undercapitalized. It is a call to action for the proven operational leader. Success is reserved for the “Quality Veteran” who is prepared to engage directly in the leadership challenges that define this mission.

Mission Profile: The Ideal Veteran Candidate

- Possesses Operational Discipline and a deep-seated adherence to following and perfecting SOPs.

- Has liquid capital of >$100k to survive the initial J-Curve and fund the working capital gap.

- Is seeking to build Legacy and Asset Value over generating quick, short-term cash flow.

- Has a professional background as a Logistics Officer, NCO, or Operations Leader —roles that directly translate to managing people and complex systems.This mission is a No-Go for passive investors, “Idea Guys,” or those seeking a low-stress, 9-to-5 operation.The demographic tide is rising, and the demand for quality care is already overwhelming the current supply. The opportunity is undeniable, but it requires leadership, not just investment. Stop watching the ‘Silver Tsunami’ from the shore. It is time for proven leaders to step forward and apply their skills to an industry that offers both high profit potential and a higher purpose.

In Closing

Senior home care offers strong long-term potential, but it’s not the right fit for everyone. The most effective next step is understanding how different franchise industries compare – and where your experience is best applied. You can explore other franchise categories on your own, or speak directly with a franchise coach to get clear on fit, expectations and next steps.